Appliance Repair Training

Richland Hills, TX

2 Week Sessions

Reasonable Pricing

Hands-on Experience

Request Call Back

Hero Request Form

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later.

Launch Your Appliance Repair Career

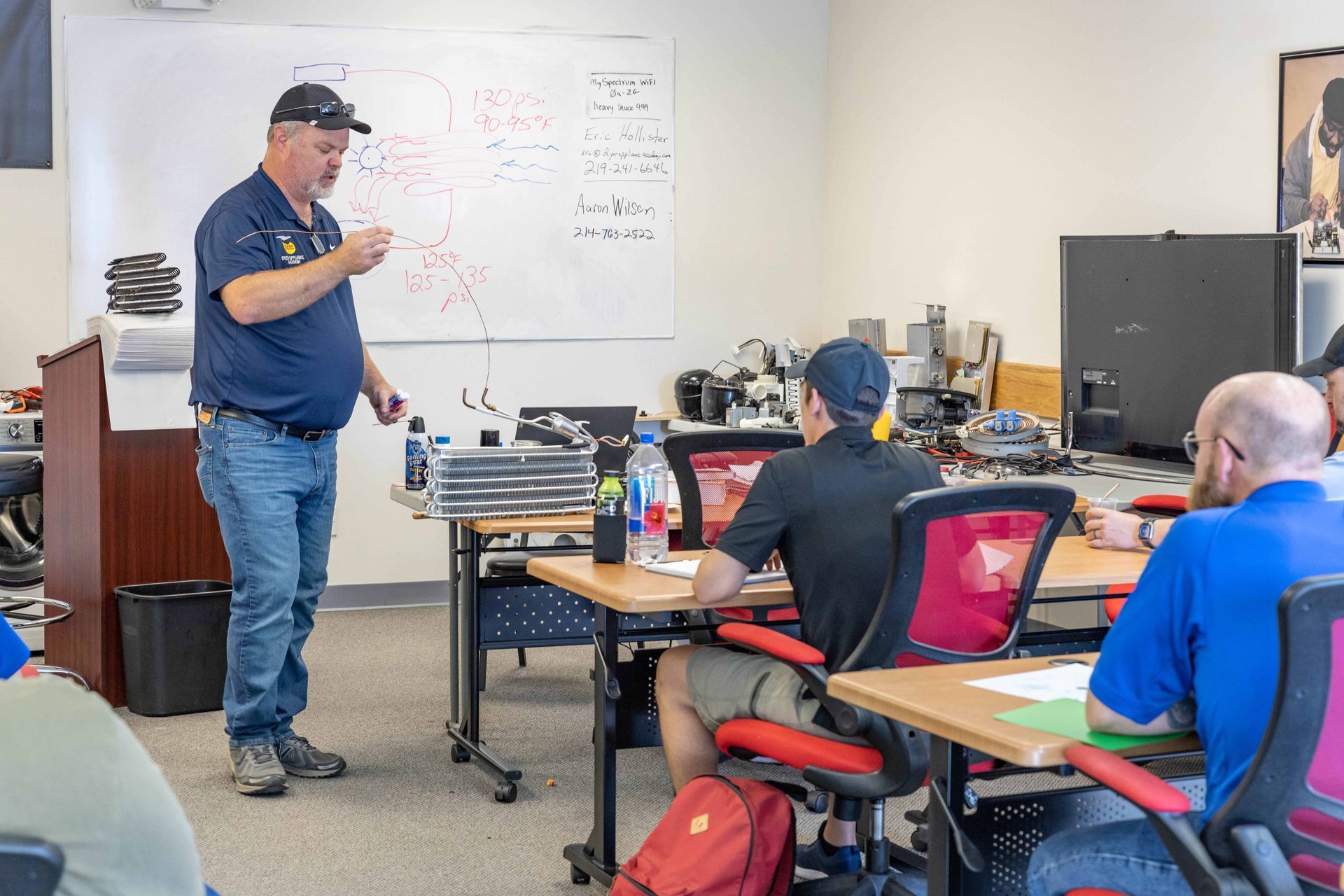

Dyer Appliance Repair Academy paves the way for a successful career in appliance repair. With over 40 years of industry experience, we've been developing skilled technicians since 2013. Our academy is one of only four in the country offering hands-on training, ensuring you gain practical skills that make you stand out in the field. As members of the United Appliance Servicers Association (UASA) and the Marcone Servicers' Association (MSA), we're committed to upholding industry standards and continuous improvement.

We prioritize personalized learning by offering one-on-one assistance to each student. Additionally, our program is designed to require minimal time and financial commitment, making it accessible for those looking to jumpstart their careers without overwhelming their schedules. Join us and take the first step towards a rewarding future in appliance repair!

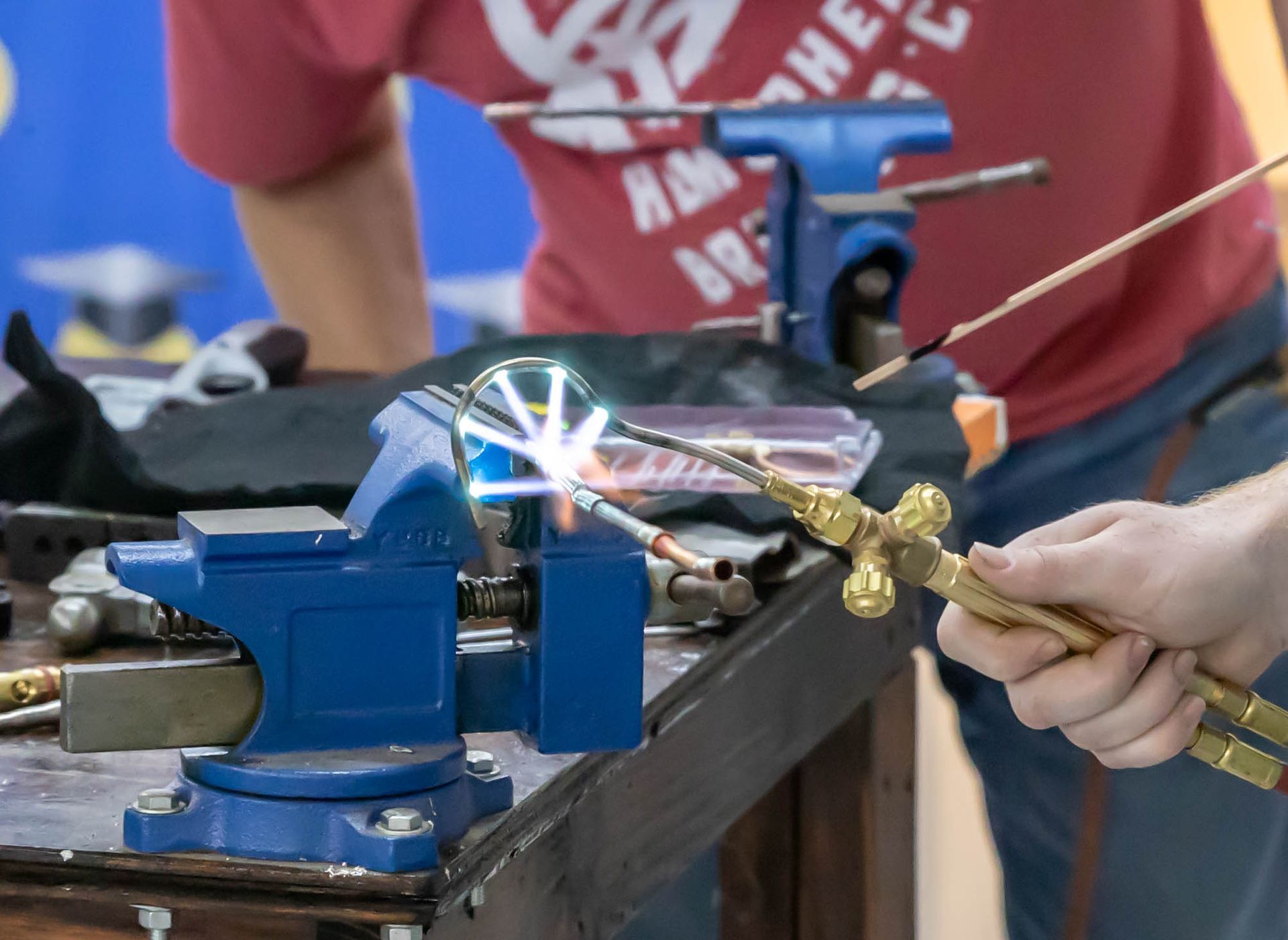

Our two-week Appliance Repair Fundamentals course covers everything from basic repairs to advanced troubleshooting techniques. The curriculum includes basic electricity, gas, and refrigeration theory, and the principles of operation, major components, and common faults of all major household appliance types. Our weekend Sealed Systems Diagnostics and Repair course is a deep dive into sealed systems repair that covers R134a and R600 and features hands-on time with Vulkan’s Lokring system.

We focus on preparing you for real-world challenges. Whether you're new to the field or an experienced technician looking to enhance your skills, our academy provides the knowledge and hands-on experience you need to succeed. Ready to boost your career? Contact Dyer Appliance Repair Academy today and begin your journey to becoming a skilled appliance repair professional.

Why Choose Dyer Appliance Repair Academy

Hands-On Experience

2-Week Sessions

Weekend Classes

One-on-One Assistance

Minimal Time and Money Commitment

Connect with Other Technicians

Our Courses and Schedule

Our program offers thorough, hands-on training in appliance repair, covering all major residential appliance types. Our two-week sessions run throughout the year, so you can choose a time that works best for you. We also offer a multi-class discount, making it easier to learn about different types of appliances. We train new hires from F&P, but we don't provide any training specific to their products. They go back to F&P for that.

Why Choose Dyer

Choosing Dyer Appliance Repair Academy is an investment in your future. With over 45 years of industry experience and 12 years as a training school, you'll learn from seasoned professionals. We offer fair pricing without cutting corners on quality, and we proudly support our military with special discounts. Our practical approach and industry connections give you a real advantage when looking for jobs.

Job Board

Our job board is a great resource for students and graduates. We've built strong relationships with appliance repair companies across the Continental US, giving you access to many job opportunities. You can find the latest job openings and connect with potential employers who value the training you've received at Dyer Appliance Repair Academy.

Links and Resources

We give our students a wide range of links and resources to support their learning. This includes technical manuals, troubleshooting guides, industry publications, and online forums. You'll have everything you need to succeed. These resources work alongside our hands-on training and help you stay up-to-date with the latest trends and technologies in appliance repair.

Lodging Options

We know many of our students travel from across the country to attend our academy. To make your stay comfortable, we provide information on various lodging options near our training center. Whether you prefer budget-friendly hotels or extended-stay accommodations, we'll help you find a great place to stay during your two-week training session.

Here's what our satisfied customers are saying...

At Dyer Appliance Repair Academy, we take pride in providing exceptional appliance repair training to our customers. We would be grateful if you could share your thoughts about our academy with others. Your feedback helps us improve and helps others make informed decisions. Please take a moment to leave a review of Dyer Appliance Repair Academy and let others know what you think.

Frequently Asked Questions

1. What makes Dyer Appliance Repair Academy different from other training programs?

At Dyer Appliance Repair Academy, we focus on providing an immersive learning environment built around real-world scenarios and practical instruction. Many people searching for appliance repair schools in Ft Worth, TX want a place where they can truly understand how appliances function—not just read about them. Our academy emphasizes hands-on skill-building, guided learning, and direct access to instructors with decades of experience. We’ve structured our program to be approachable, efficient, and supportive, giving students a clear path toward confidence and capability in the appliance repair field.

2. What type of student is best suited for your training programs?

Our academy is a strong fit for anyone serious about developing technical ability, whether you're entering the industry for the first time or seeking to build upon existing mechanical knowledge. Students often choose us because they want an environment that fosters practice, patience, and understanding—not just lectures. Many who compare appliance repair schools in Ft Worth, TX find that our academy offers a comfortable learning pace and a practical approach that accommodates different experience levels. We welcome individuals who learn best by doing and who are committed to building long-term skill sets.

3. How long does the training take, and what should I expect during the program?

We offer structured programs that allow you to progress efficiently without sacrificing depth. During your time with us, you can expect direct guidance, hands-on exercises, and a clear walkthrough of the essential concepts needed to understand appliance operation and repair. Many people researching appliance repair schools in Ft Worth, TX are surprised to learn that comprehensive training can be completed in a relatively short window while still being highly effective. Our goal is to deliver meaningful, practical instruction in a format that respects your time and sets you up for real-world readiness.

4. Does Dyer Appliance Repair Academy help students after they complete their training?

Yes. While we don’t make guarantees regarding employment, we believe in supporting students beyond the classroom. Graduates gain access to job listings and employer connections that can help them explore opportunities nationwide. Because we have long-standing relationships across the appliance repair community, many companies recognize the quality of training our students receive. When comparing appliance repair schools in Ft Worth, TX, prospective students often appreciate our commitment to staying engaged with them as they take their next steps into the workforce.

5. Do students need prior experience in appliance repair or electrical work?

No prior experience is required. Our programs are built to be beginner-friendly while still robust enough for individuals with some technical background. We start with foundational concepts and gradually work toward more advanced principles, ensuring everyone gains a solid understanding. Students evaluating appliance repair schools in Ft Worth, TX often choose our academy because they want accessible training that doesn’t assume previous knowledge. We’re here to teach you from the ground up and help you build confidence as your skills grow.

6. What kind of support is available for students traveling from out of town?

We recognize that many of our students come from outside the local area, which is why we offer guidance on lodging options located near our training facility. Whether you’re staying for a short session or planning an extended visit, we can point you toward comfortable and convenient accommodations. For individuals looking at appliance repair schools in Ft Worth, TX, having this type of support can make the planning and enrollment process much smoother. Our goal is to ensure that your time with us—both inside and outside the classroom—is as stress-free as possible.